Pierre Rochard Consults With Jamie Diamond On How To Avoid Insolvency

Pierre Rochard (VP of Research at Riot Blockchain) recently met with Jamie Diamond (CEO of JP Morgan Chase), to discuss potential ways for the massive bank to avert insolvency in the midst of an unprecidented bank run. Diamond told Rochard that he had seen his tweet about selling chairs for Bitcoin and wanted to know how he could liquidate all of JP Morgan's chairs in such an illiquid market.

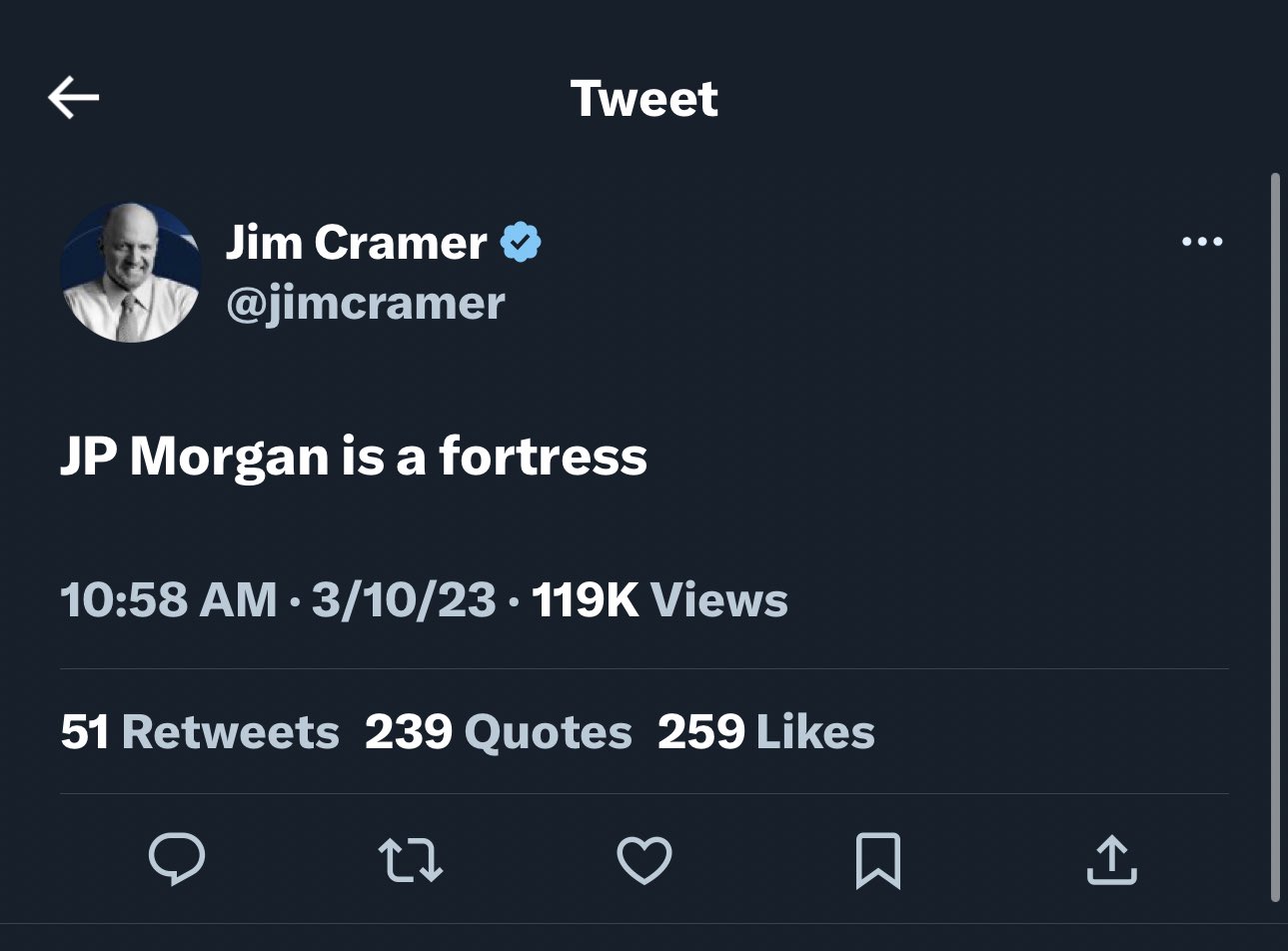

Questions of whether or not JP Morgan is solvent came up after Jim Cramer tweeted that the mega bank is a "Fortress." Wall Street Bets then lead a bank run as depositors from all over the country quickly rushed to the bank Tuesday morning to withdraw all their funds.

Jamie Diamond called an emergency meeting with the board Monday night to discuss how to possibly prevent a calamity. They discussed ways to liquidate assets to be able to cover their customers deposits. One of the main concerns they had was that the company had failed to verify if the assets they had owned were legitimate or fradulent as seen by the large amount of nickel they had that was actually just stone.

In a moment of desperation, as the board bickered, Jamie pounded his fist on the table and declared, "The chairs we are sitting on are real, why don't we just sell those. We have tons of these across our bank branches." One of the board members suggested that they bring in Pierre Rochard as an advisor on the chair liquidation.

The first problem to solve was the lack of market liquidity for chairs. Commercial real estate is performing poorly so there is not much of a market there. Governments move to slowly in regards to buying it. Individuals in the retail market are too high maintenance to handle efficiently.

"People are selling their chairs right now in order to buy Bitcoin because they don't trust the banks. How is JP Morgan going to sell the chairs from 900 bank branches into a market that's already full of seller and lacking buyers," Diamond told Rochard.

Rochard responded, "Jamie, we are dealing with a free market. This is not a situation you can fix with a money printer, or by going to a regulator. The only way to liquidate all of JP Morgan's chairs is to have a competitive market price."

Diamond agreed to sell the chairs for a rock bottom price and all of them were picked up by Wells Fargo as an attempted inflation hedge.